The Fibonacci Sequence Is Everywhere—Even the Troubled Stock Market

The curious set of numbers shows up in nature and also in human activities.

published : 26 March 2024

On Friday, March 20, as the U.S. stock market closed out its worst week since 2008 amid coronavirus-related turmoil (before recovering somewhat early the following week), investors were left with a glaring question: Is it all downhill from here? Amid such economic turbulence, some market researchers look to a familiar, powerful set of numbers to predict the future.

“Fibonacci retracement” is a tool that technical analysts use to guide their outlook about buying and selling behavior in markets. This technique is named after and derived from the famous Fibonacci sequence, a set of numbers with properties related to many natural phenomena. While using these numbers to predict market movements is a lot less certain than using it to calculate sunflower seed patterns, the appearance of the sequence in the field of finance is yet another testament to its power in capturing the human imagination.

What is the Fibonacci sequence?

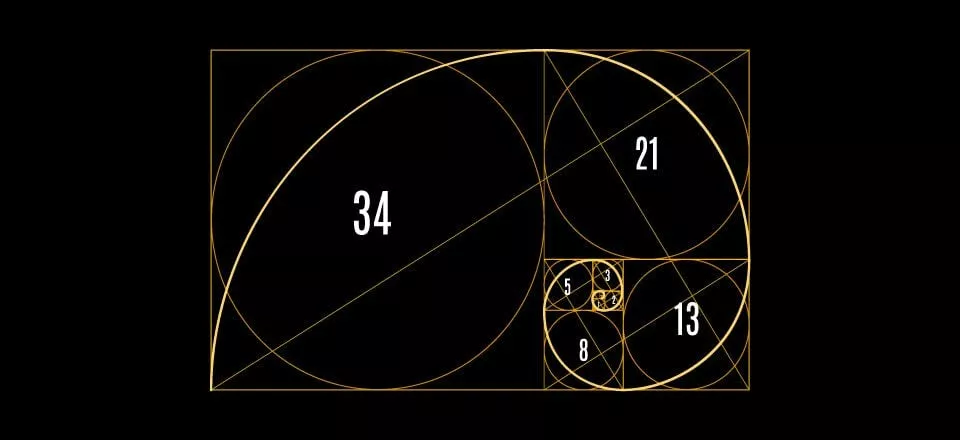

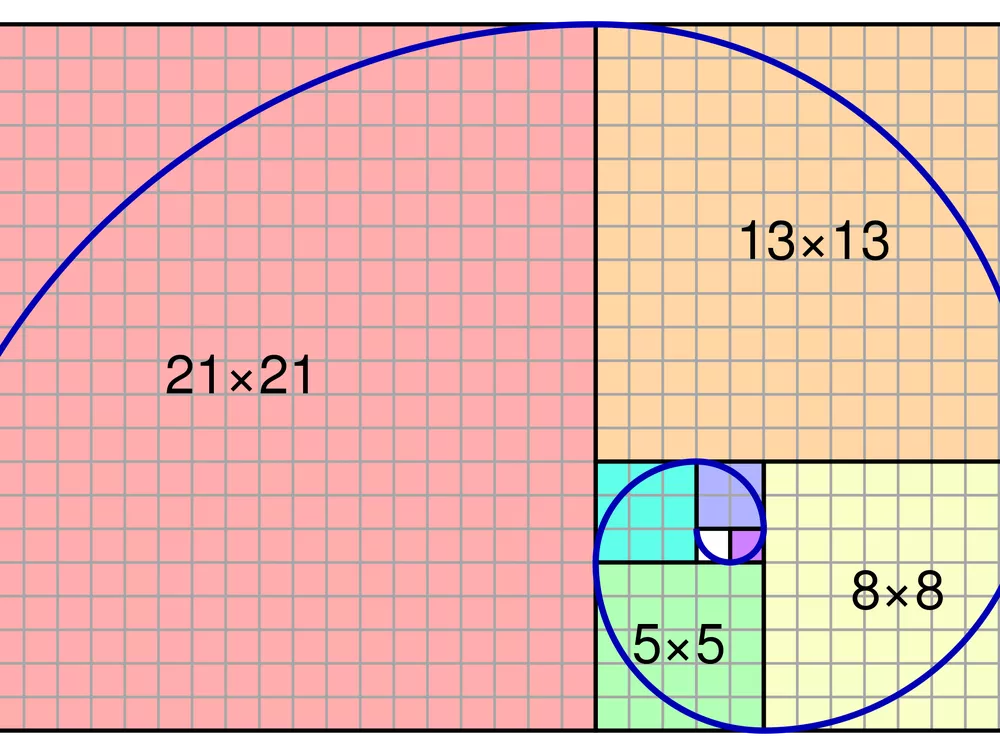

The Fibonacci sequence is a famous group of numbers beginning with 0 and 1 in which each number is the sum of the two before it. It begins 0, 1, 1, 2, 3, 5, 8, 13, 21 and continues infinitely. The pattern hides a powerful secret: If you divide each number in the sequence by its predecessor (except for 1 divided by 0), then as you move toward higher numbers, the result converges on the constant phi, or approximately 1.61803, otherwise known as the golden ratio.

The sequence has a long history. In Europe, it was the solution to a problem of rabbit breeding described in the book Liber Abaci by the Italian mathematician Leonardo of Pisa in 1202 A.D. But the pattern was known in India much earlier, possibly even the seventh century. The sequence’s name comes from a nickname, Fibonacci, meaning “son of Bonacci,” bestowed upon Leonardo in the 19th century, according to Keith Devlin’s book Finding Fibonacci: The Quest to Rediscover the Forgotten Mathematical Genius Who Changed the World. Mathematician Eduoard Lucas then gave the name “Fibonacci sequence” in the 1870s to the sequence derived from the rabbit scenario. (It has also shown up in counting the numbers of bees in successive generations).

The golden ratio, meanwhile, can be written as one-half of the sum of 1 plus the square root of 5. And while phi does not get a pastry-filled holiday like pi, the constant appears in natural phenomena. The numbers of spirals in pinecones are Fibonacci numbers, as is the number of petals in each layer of certain flowers. In spiral-shaped plants, each leaf grows at an angle compared to its predecessor of 360/phi2, and sunflower seeds are packed in a spiral formation in the center of their flower in a geometry governed by the golden ratio, too.

“The Golden Ratio’s attractiveness stems first and foremost from the fact that it has an almost uncanny way of popping up where it is least expected,” writes Mario Livio in The Golden Ratio: The Story of Phi, the World's Most Astonishing Number.

But why is this sequence so ubiquitous? “A lot of things in mathematics and probably in the real world are governed by simple recursive rules, where each occurrence is governed by a simple formula in terms of the previous occurrence,” said Ken Ribet, professor of mathematics at the University of California, Berkeley. “And a Fibonacci number has the simplest possible formula, just the sum of the previous two.”

Fibonacci Goes to the Market

Humans are hardwired to identify patterns, and when it comes to the Fibonacci numbers, we don’t limit ourselves to seeking and celebrating the sequence in nature. Fibonacci and phi can be found in certain works of art, architecture and music (although it is a myth that Egypt’s pyramids have anything to do with it). And while buying and selling behavior is largely unpredictable, some financial analysts swear they can see these numbers at play there, too, including in this current economic crisis.

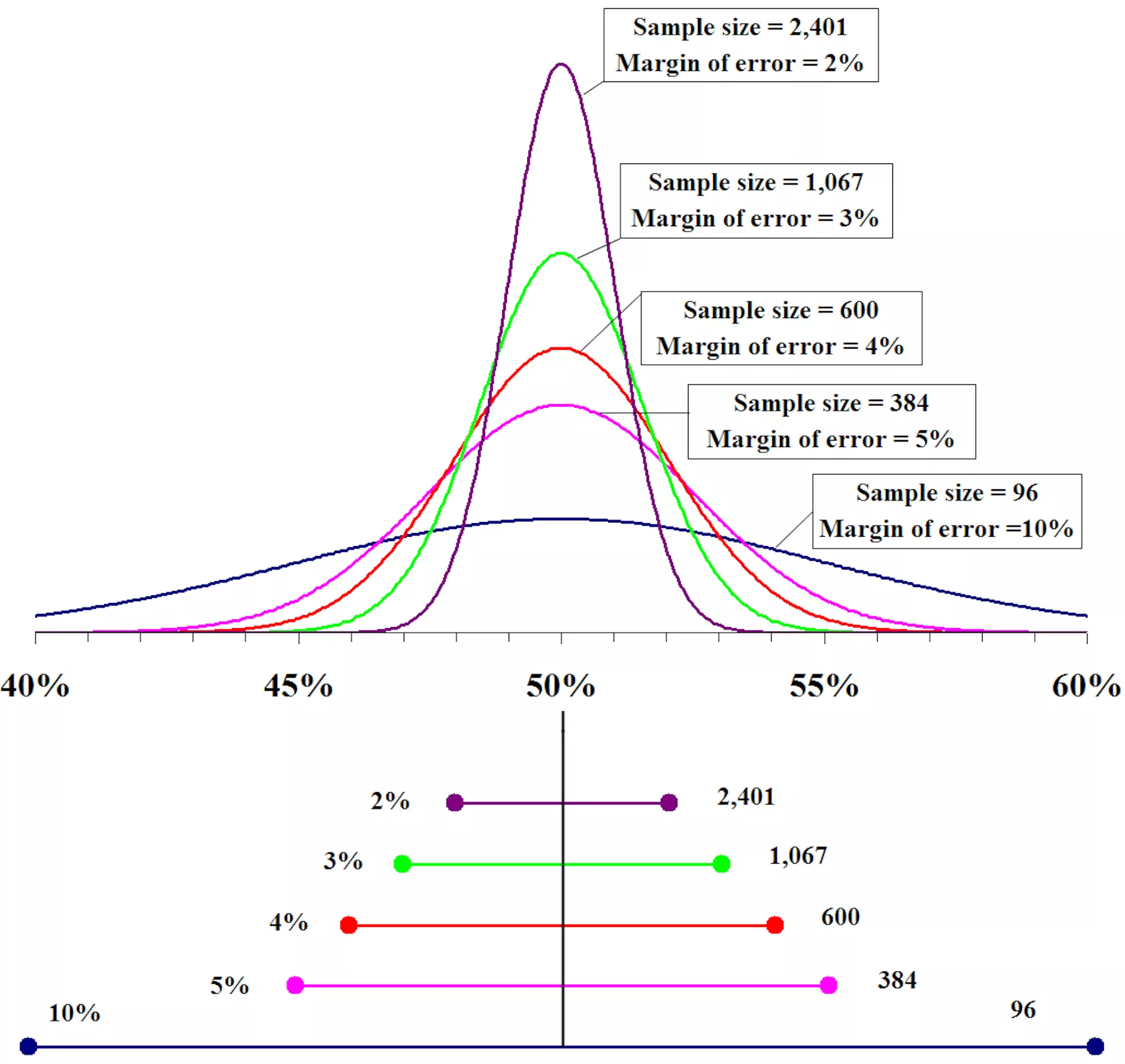

Investment researchers called “technical analysts” look at the historical shapes of charts to determine whether a current buying or selling trend will continue or turn around. Some make their predictions using “Fibonacci retracement levels,” derived from the famous sequence.

Technical analysts may look at a whole suite of numbers corresponding to ratios of numbers in the Fibonacci sequence, but a couple of important ones are 61.8 percent and 38.2 percent. Any given Fibonacci number divided by its successor approximates 1/phi, or 0.618. A Fibonacci number divided by the number two places higher in the sequence approximates 0.382.

For example, consider the S&P 500. In the depths of the 2008 recession, the index hit its lowest point in 2009 at 666 points. Since then it has generally been on a longterm upward climb, reaching a peak of 3,393 before the coronavirus-induced plummet in recent weeks.

To make sense of the trends of this current downturn, Katie Stockton, founder and managing partner of the technical analysis firm Fairlead Strategies, LLC in Stamford, Connecticut, is looking at whether key indexes and stocks break through various levels. If you take the 2009 low of 666 as the bottom (0 percent) and the 2020 high of 3,393 as the top (100 percent), Stockton is watching for whether the S&P 500 closes two Fridays in a row below what she identifies as the “support level” of 38.2 percent. That level corresponds to the high of 3,393 minus 1,042 (38.2 percent of the difference between the high and low), which comes to 2351.

So far during the crisis, prices have not dipped so low two Fridays in a row, although on March 20 the index did close at a dismal 2304.92. If it closes out March 27 below that Fibonacci level of 2351, it would be the second strike in a row. This would indicate to analysts like Stockton that the S&P risks sliding down farther to the 61.8 percent level, or about 1708—making now a less optimal time to buy, according to this view.

A Self-Fulfilling Prophecy?

Ribet, the mathematician, dismisses the notion of looking for Fibonacci-sequence-related patterns to predict markets. But even if it’s not true that Fibonacci numbers relate to fundamental market forces, markets by design react to the beliefs of their players. So if investors buy en masse because of Fibonacci analysis, they create an upward trend anyway; likewise for selling.

Stockton acknowledges that this at least in part explains the movement of gold last year when investors closely monitored whether the price of an ounce would rise beyond a particular Fibonacci level. Gold prices fell significantly from 2012 to 2015, then bounced around between about $1,200 and $1,400 per ounce for four years until June 2019, when it appeared to be on the upswing again.

“That was a big Fibonacci breakout that a lot of folks were watching, even to the extent that it became such a widely followed level that I think there becomes some self-fulfilling property to it,” Stockton said.

The idea that Fibonacci numbers govern human stock trading could be magical thinking, but enough people with the same magical thinking can move markets. As we brace ourselves for more chaos, at least we can all take comfort in knowing the Fibonacci numbers themselves are eternal.