The Mathematics of Risk Management

Risk management is a vital aspect of decision-making in various fields, including finance, insurance, engineering.

published : 30 March 2024

Risk management is a vital aspect of decision-making in various fields, including finance, insurance, engineering, and healthcare. Mathematics provides powerful tools and techniques for quantifying, analyzing, and mitigating risks, allowing individuals and organizations to make informed decisions and minimize potential losses.

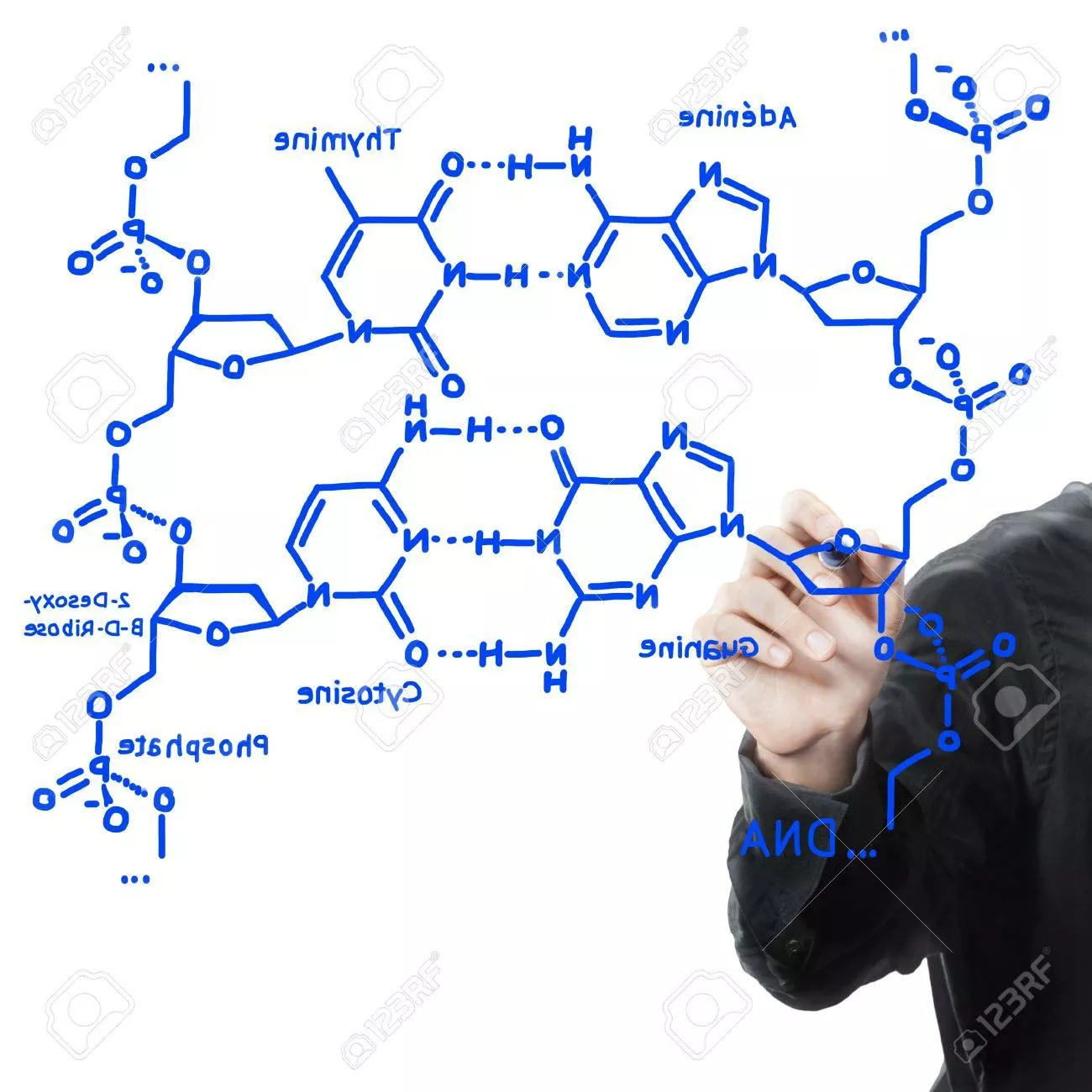

Probability Theory

Probability theory is the branch of mathematics that deals with the analysis of random phenomena and uncertainty. It provides a framework for quantifying the likelihood of different outcomes and making predictions based on available information. In risk management, probability theory is used to assess the probability of various events and their potential impact on outcomes.

By understanding the probabilities associated with different risks, individuals and organizations can make informed decisions about how to allocate resources, manage exposure, and implement risk mitigation strategies. Probability theory allows risk managers to quantify risks in terms of probabilities, expected values, and measures of uncertainty, enabling them to assess the potential impact of different courses of action.

Statistical Analysis

Statistical analysis is another important tool in risk management, allowing practitioners to analyze historical data, identify patterns and trends, and make predictions about future outcomes. Statistical techniques such as regression analysis, time series analysis, and Monte Carlo simulation are used to model complex systems and assess the likelihood of different scenarios.

By analyzing historical data and using statistical models to simulate possible future outcomes, risk managers can gain insights into the potential risks and opportunities associated with different courses of action. Statistical analysis enables risk managers to make data-driven decisions and develop strategies for managing and mitigating risks effectively.

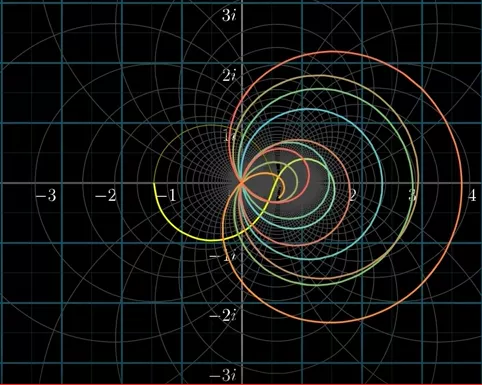

Financial Mathematics

Financial mathematics is a specialized branch of mathematics that focuses on the analysis of financial markets, instruments, and transactions. It plays a crucial role in risk management, particularly in the field of finance, where the management of financial risks such as market risk, credit risk, and operational risk is essential for ensuring the stability and profitability of financial institutions and markets.

Financial mathematics provides tools and techniques for valuing financial assets, hedging against risks, and optimizing investment portfolios. Concepts such as portfolio theory, option pricing, and risk-neutral valuation are used to assess and manage financial risks effectively, allowing investors and financial institutions to protect themselves against adverse market movements and maximize returns.

Conclusion

The mathematics of risk management provides a rigorous and systematic framework for assessing, analyzing, and managing risks in various fields. By applying mathematical tools and techniques such as probability theory, statistical analysis, and financial mathematics, individuals and organizations can make informed decisions and mitigate potential losses effectively.

As we navigate an increasingly complex and uncertain world, the mathematics of risk management plays an indispensable role in helping us understand and manage risks, enabling us to make better decisions and achieve our objectives with greater confidence and resilience.